inheritance tax calculator florida

It is sometimes referred to as a death tax Although states may impose their own. Spouses are automatically exempt from inheritance taxes.

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Inheritance tax is imposed on the assets inherited from a deceased person.

. Florida residents may still pay federal estate taxes though. The federal estate tax exemption for 2021 is 117 million. The tax rate varies.

Like most other states Florida does not levy a local gift tax. The estate tax exemption is adjusted for inflation every year. Overview of Florida Taxes.

There is no inheritance tax or estate tax in Florida. Property Tax How To Calculate Local Considerations. The federal estate tax only.

Inheritance tax is imposed as a percentage of the value of a decedents estate transferred to beneficiaries by will heirs by intestacy and transferees by operation of law. Florida has no state income tax which makes it a popular state for retirees and tax-averse workers. For the estate tax a Florida resident or for that matter any United States citizen or resident alien may leave an estate with a value of up to 5340000 free of US estate tax or inheritance tax.

Overall inheritance tax rates vary based on the beneficiarys relationship to the deceased person. The good news is that the federal estate tax applies only if the overall total of the estate is greater than 1206 million 2022 figures. The tax rate on.

Inheritance tax calculator florida Wednesday August 31 2022 Edit. Pension income and income. Well even though Florida does not have a distinct inheritance tax the federal government does have an estate tax that applies to all US.

The size of the estate tax exemption means very. Gift tax helps to plan your estate in Florida. Our Florida retirement tax friendliness calculator can help you estimate your tax burden in retirement using your Social Security 401k and IRA income.

If youre moving to Florida from a state that levies an income. An estate tax is a tax imposed on the total value of a persons estate at the time of their death. At the same time the Federal Gift Tax Exclusion has an annual.

Inheritance Tax Calculator Florida. An estate tax is a tax imposed on the total value of a persons estate at the time of their death. Florida Income Tax Calculator 2021.

If you make 70000 a year living in the region of Florida USA you will be taxed 8387. Is inheritance taxed in Florida. There is no estate tax in Florida as it was repealed in 2004.

Some states and a handful of federal governments around the world levy this tax. Florida Estate And Inheritance Taxes Estate. Florida Inheritance Tax and Gift Tax.

Your average tax rate is 1198 and your marginal tax rate is. You can contact us at arnold law to explore your options for navigating the estate and inheritance process. Some people are not aware that there is a difference however the.

Tax Implications Of The Florida Lady Bird Deed Ptm Trust And Estate Law

Kansas State Taxes Ks Income Tax Calculator Community Tax

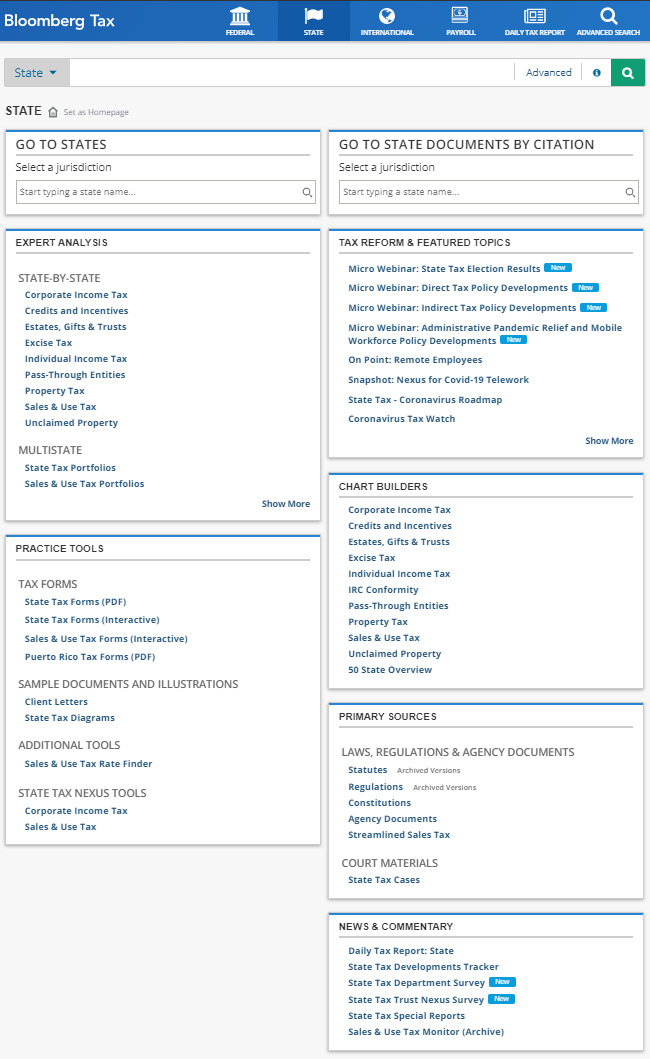

Getting Started Bloomberg Tax Bloomberg Tax

Easiest Capital Gains Tax Calculator 2022 2021

States With Estate Tax Or Inheritance Tax 2021 Tax Foundation

What You Need To Know About Estate Tax In Fl

Florida Estate Tax Everything You Need To Know Smartasset

Biden Estate Tax 61 Percent Tax On Wealth Tax Foundation

How To Calculate Property Taxes Real Estate Scorecard

The State Of Estate Planning 2022 New Jersey Law Journal

:max_bytes(150000):strip_icc()/beautiful-old-couple-619409150-d7a3f4b5f2874a55a0195b8c53d9d3b9.jpg)

Calculating Your Potential Estate Tax Liability

Inheritance Tax Who Why How Internal Revenue Code Simplified

Florida Intangible Tax And Transfer Tax How Do You Calculate These Closing Costs Usda Loan Pro

Florida Estate Tax Rules On Estate Inheritance Taxes

First Time Home Buyer Program Florida Mcc Tax Certificate Program

Tax Tips For Selling A House In Florida Florida Cash Home Buyers

Florida Dept Of Revenue Property Tax Data Portal

The Dreaded New Jersey Inheritance Tax How It Works Who Pays And How To Avoid It Nj Com